registering for a paymennt merchant account

This guide will walk you through the process of registering for a paymennt merchant account.

Once you’ve submitted your application, you’ll join a short queue. Our team will review your application and may reach out to you to confirm a few details or, most probably, will leave you a message on your application, guiding you through the still required information/ documentation. The onboarding process timeframe depends on the complexity of your company and the documents uploaded.

Before starting, you must have downloaded the paymennt mobile application. Learn more

The user setting up the account must be an authorized signatory of the entity for which the paymennt merchant account is being created.

Account verification

Before beginning the registration process, familiarize yourself with our Account Verification Requirements

Required Documents

Please make sure you have available the following documents and information as they will be required during the registration process:

- Company Trade License issued by a registration authority in a supported country

- Government Issued ID of authorized signatory (Emirates ID or National ID)

- Government issued IDs (EID, National ID, Passport, etc) of shareholders and owners more than 25% of the company

Account Registration Process

Account Country Selection

To start, launch the paymennt mobile application:

- Launch the paymennt app

- Select the country of registration

Applicant KYC (Know Your Customer)

The following steps allow us to identify you as an applicant and to verify your identity. This is required as part of our regulators and card scheme obligations.

- Enter your phone number. This number will be used to log you in in the future to complete your application and to access your paymennt merchant account using the application.

- One Time Password. Verify your phone by entering the 6 digit code received via SMS.

- Security Pin. Create a 4 digit pin code which can be used going forward to access your account.

- Personal Infomartion. Provide your name and contact email address. Please note that this email address will be the primary email address used for communications regarding your account.

- Government Identity Card. We require a government ID as part of our identity verification and background checks. You must physically have the ID on you. Your account will be rejected if you are taking a picture from a computer screen or a print out.

- Face Verification. To match your account with your government issued identity card, we require a live photo be taken using our application. Our platform will compare this photo with the one on the ID uploaded in step 5 above.

Business KYB (Know Your Business)

The following steps allow us know your business and validate your corporate and business registration. This is required as part of our regulators and card scheme obligations.

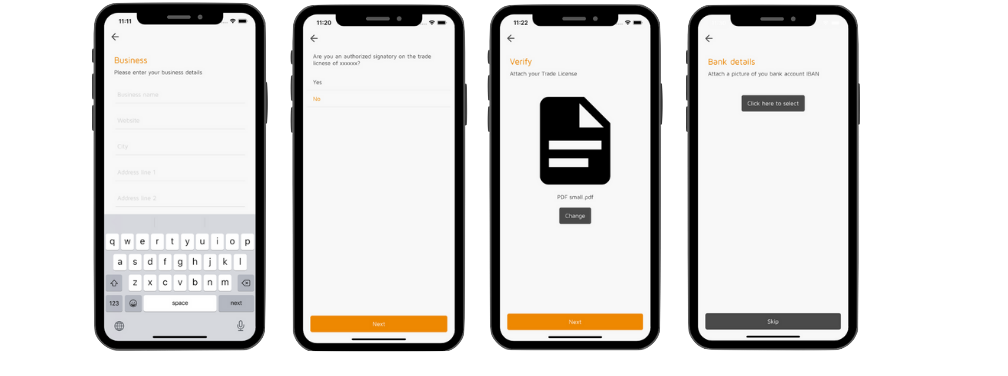

- Business Information. Provide your business information including business name, website (or facebook/instagram profile urls), location, and address.

- Authority Verification. Verify if your name is listed as a manager on the business trade license. If your actiting on behalf of the manager, you must upload a valid Power of Attorney (PoA) from the manager / owner. We will not accept an application where the applicant is not authorized to sign on behalf of business.

- Trade License. In this step, please upload your trade license. At a minimum, the trade license should show the following details; a) issuing authority, b) registration number, c) company name, d) issue date, e) expiry date, f) managers (or authorized signatories), g) details of sharholders. Your application may be delayed if any of these details are missing.

- Bank Account. This is the bank account where funds paid by your customers will be transferred to. This must be a bank account in the same country as your registraiton.